Our products KANTARA

KANTARA is a modular and secure digital banking solution for companies, which allows optimized and multi bank management of their cash flow. Give your business customers the means to optimize the management of their liquidity to make it a lever for growth and create value.

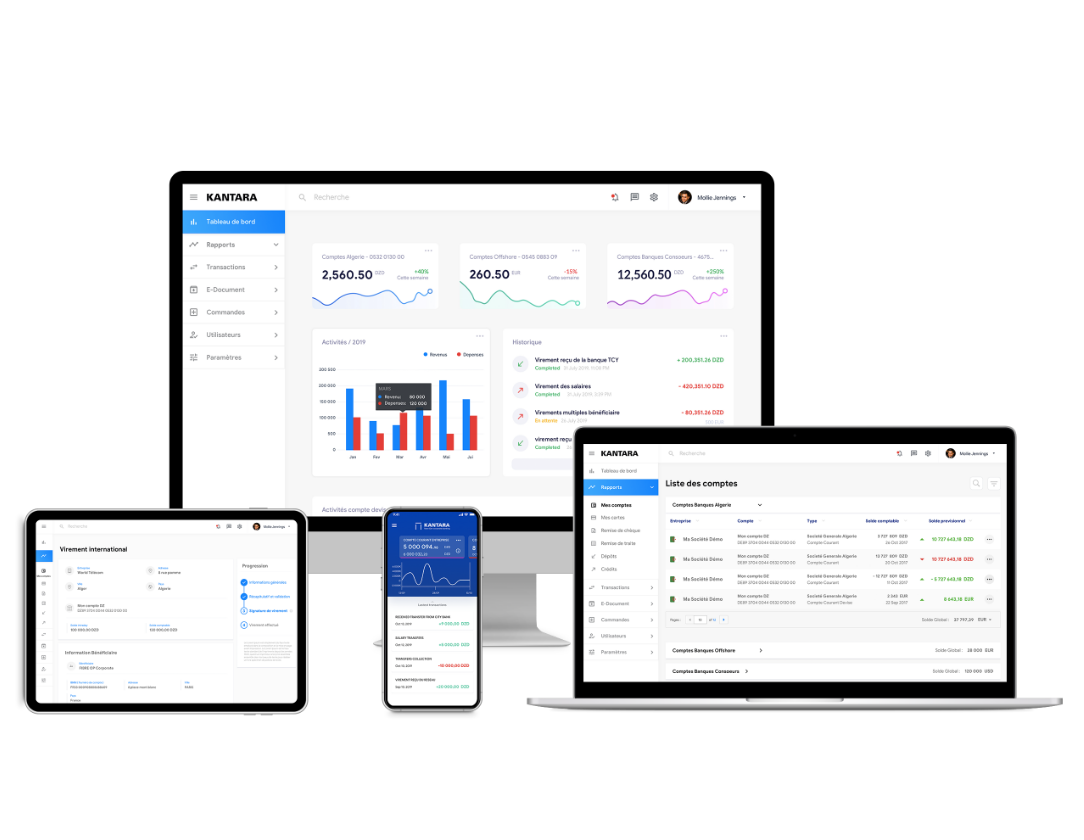

Thanks to a single access, KANTARA allows companies to easily manage their cash flow and balance all types of accounts.

KANTARA has user management modules and their authorizations, which can interface directly with their internal systems. This solution to international standards (DSP2) is also able to support several companies, organizations, currencies or countries.

Based on an omnichannel approach, KANTARA offers a real-time experience and allows full transparency on all devices.

by providing your customers with a high-performance solution.

For more than 15 years BEYN has supported dozens of banks in their digital transformation.

More than a commercial relationship, we build a real partnership with you to achieve common goals.

« YOU CAN COUNT ON THE EXPERTISE OF OUR TEAMS TO TAKE FULL ADVANTAGE OF OUR SOLUTIONS. »